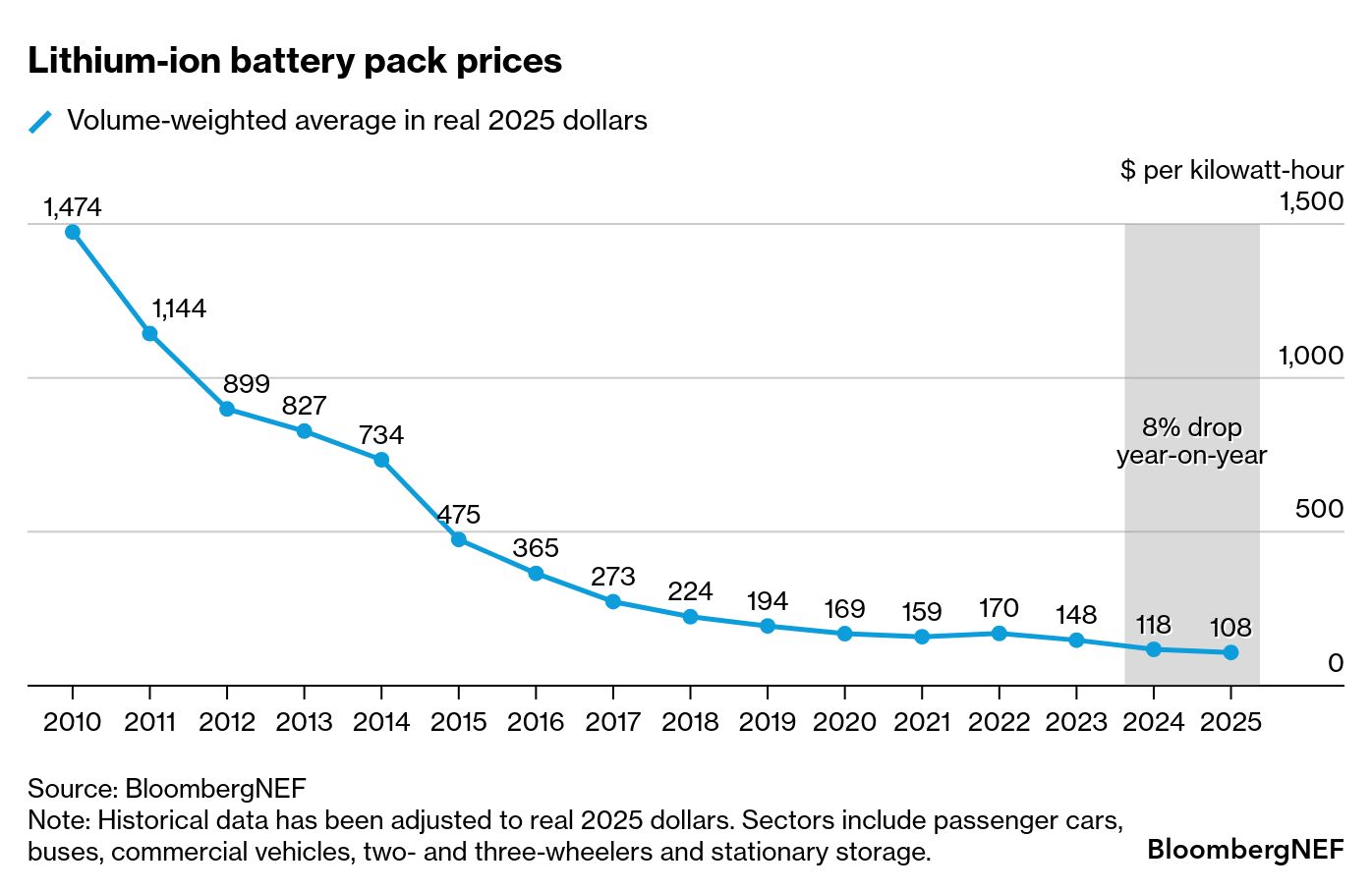

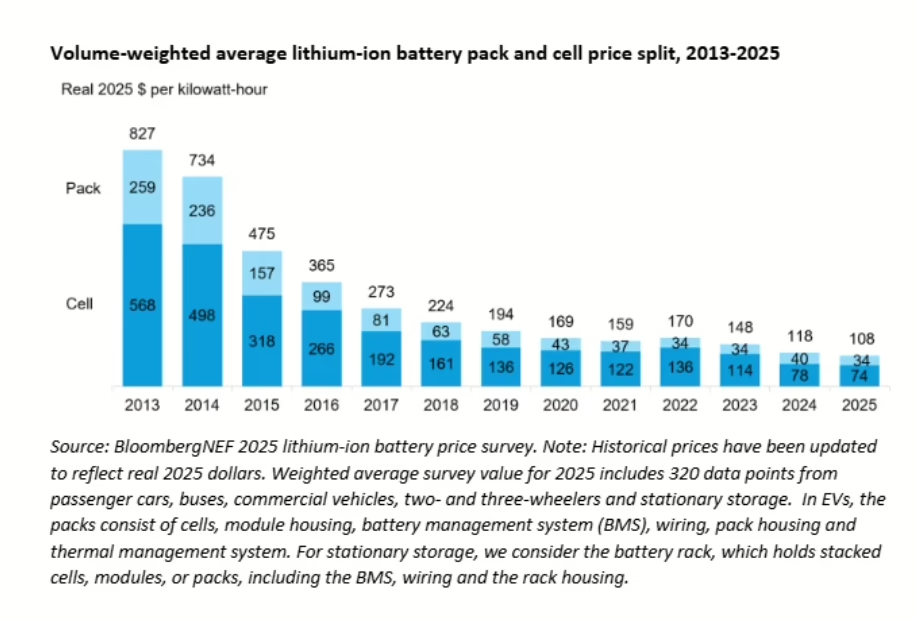

While the pace of price decreases has slowed, lithium-ion battery packs have reached a new record low in 2025. According to the latest analysis by BloombergNEF (BNEF), prices have fallen 8% since 2024 to $108/kWh, making them 93% lower than in 2010.

Despite an increase in battery metal costs, continued cell manufacturing overcapacity, intense competition and the ongoing shift to lower-cost lithium iron phosphate (LFP) batteries helped drive down pack prices, according to BNEF’s 2025 Lithium-Ion Battery Price Survey.

Battery metal prices rose in 2025 due to supply risks in Chinese lithium operations and new cobalt export quotas in the Democratic Republic of Congo. However, higher metal costs did not increase cell or pack prices, as the industry offset them through LFP adoption, long-term contracts, and hedging. China’s consistent oversupply of cells has fueled intense competition, especially in stationary storage, while its dominance in LFP production met nearly all global demand.

BNEF’s battery price survey – which spans multiple end uses, including various electric-vehicle types and stationary-storage applications – reveals pronounced differences across sectors. Battery pack prices for stationary storage fell to $70/kWh in 2025, 45% lower than in 2024. This was the steepest decline of any segment, making stationary storage the lowest-priced category for the first time. In the transport sector, battery-electric vehicle packs were the cheapest at $99/kWh, marking the second consecutive year they remained below the $100/kWh threshold.

Average LFP battery pack prices across all segments came in at $81/kWh while nickel manganese cobalt (NMC) packs were at $128/kWh.

The report also covers regional differences in pricing. Average battery pack prices were lowest in China, at $84/kWh. Pack prices in the North America and Europe regions were 44% and 56% higher, reflecting higher local production costs and greater dependence on imported batteries, which typically come at a premium.

China saw the largest drop in battery pack prices, down 13% in real terms from 2024, while North America and Europe experienced declines of 4% and 8%, respectively. Prices fell more in Europe than in North America due to shifting US policies and tariffs. Many Chinese companies redirected exports to Europe, adopting aggressive pricing strategies to maintain global sales volumes and meet annual targets, which intensified competition in the region.

“Cut-throat competition is making batteries cheaper every year. This is an important moment for the industry, as record-low battery prices create an opportunity to lower EV costs and accelerate the deployment of grid-scale storage to support renewables integration around the world,” said Evelina Stoikou, the head of BNEF’s battery technology team and lead author of the report.

BNEF expects battery pack prices to decline again in 2026, as raw material costs rise but LFP adoption continues to expand as a lower cost option. Over the longer term, ongoing investments in R&D, manufacturing efficiency, and supply chain growth are expected to further push costs down. Emerging technologies, such as silicon and lithium-metal anodes, solid-state electrolytes, new cathode materials, and advanced cell manufacturing processes, are in the mix to support price declines.